Need Help? Click Below

ERC Filing Deadlines

An eligible employer claiming a refundable credit for any quarter in 2020 must file its 941x forms by April 15, 2024.

An eligible employer claiming a refundable credit for any quarter in 2021 must file its 941x forms by April 15, 2025.

Essential Forms & Marketing

ERC Deal + Collection Stages

Referral Partner Zoom Calls

RP E-mail Templates

E-mail template (testimonial optional) – Suggest you customize to your specific targets:

Dear (ERC Prospect),

I’m checking in to see if your company has applied for the Employee Retention Credit? I know (Jason see below and attached) well and he handled this for my company. The process is made simple by Bottom Line and my (Practice/Restaurant/Business) will be getting back about $10,000 per W2 employee. ERC is a refund in the form of a grant and can return up to $26,000/employee ($10,000 is the average) depending on wages, health care and other personnel expenses business owners have already paid.

Essentially all businesses qualify for ERC unlike PPP loans since you don’t have to show a decline in revenues but if you do have a decline the grant is automatic. Please pass this along to anyone you may think would be interested. A requirement of the grant eligibility is to be less than 500 employees per Federal Employee Identification Number (FEIN).

Sincerely,

{Your Signature}

Thank you for your interest in Bottom Line Savings and our Employee Retention Credit, ERC, program.

Here are some important points to consider for your business:

If companies received PPP, they still qualify for ERC.

ERC is a refund in the form of a grant and can return up to $26,000/employee ($10,000 is the average for companies that received PPP)

Companies don’t have to prove loss of revenue; operational impacts qualify as well.

With our ERC program, Bottom Line is assisting companies recover taxes and wages they have already paid on their W2 employees.

Since the start of ERC, Bottom Line has filed over 13,000+ claims on behalf of small businesses for grants totaling over $2.1 billion.

These articles will provide additional background on recent developments with the ERC program:

IRS Extension

IRS Eligibility

IRS ERC & PPP

Infrastructure Bill article

IRS Website

I have also attached our ERC overview and qualifications documents. Please let me know if you have any questions or concerns.

Best Regards,

{Your Signature}

{Client Name},

I trust this email finds you doing well. Over the past few months, I’ve been made aware of a government-sponsored stimulus program designed to help businesses that were able to retain their employees during the Covid-19 pandemic. When I first heard of the program, I was skeptical. But after learning more I decided to go through the process for my company and found out I am eligible for a 7-figure refund, I was immediately convinced.

I’m reaching out as I believe you can also benefit from this program.

This stimulus program was established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that your business can claim. The program is based on qualified wages and healthcare paid to employees.

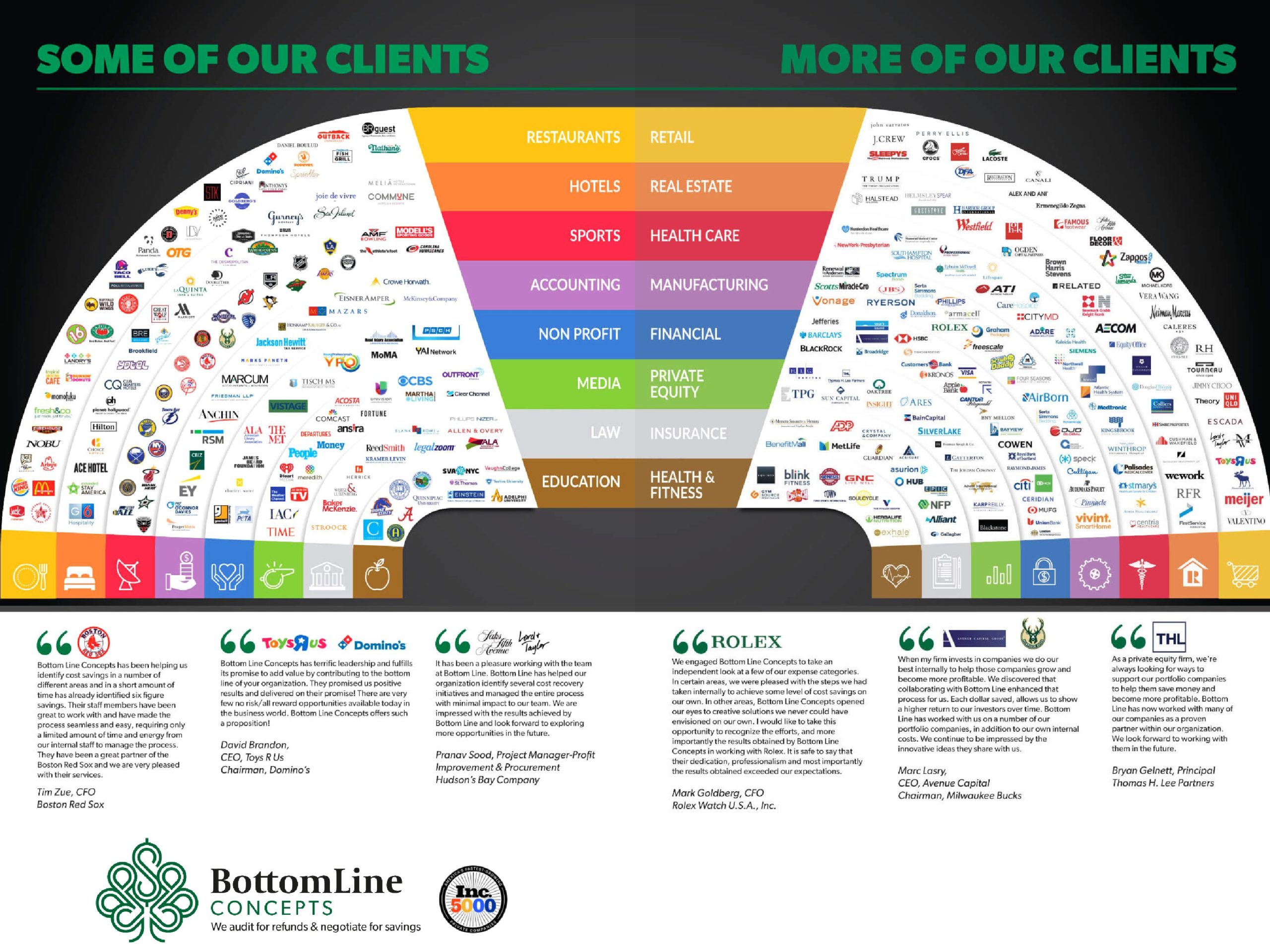

I work with a 3rd party advisor that will walk you through the process, give you a refund estimate and process the refund with the IRS. They are a one-stop-shop from start to finish. This 3rd party has done this process for over 7,000 customers and recovered over 2 billion in refunds. They have been in business since 2009 and work with many of the Fortune 500.

It is my belief that your business would be able to receive this refund. If you are interested in learning more, please reach out to me and I will get the process started for you.

I look forward to hearing from you and to helping you with this once-in-a-lifetime opportunity.

Sincerely,

{Your Signature}

Información disponible en español

Related Links

IRS ERC Guidelines

U.S. One Pagers

Industry One Pagers

Frequently Asked Questions

An eligible employer claiming a refundable credit for any quarter in 2020 must file its 941x forms by April 15, 2024. An eligible employer claiming a refundable credit for any quarter in 2021 must file its 941x forms by April 15, 2025.

There are two ways to qualify: EITHER a change in your operations OR a revenue decline. You do not need a revenue decline to qualify, in fact many businesses had a revenue increase and still qualified.

ERC is a stimulus program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic. Established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that you can claim for your business. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

Here are some impacts to consider that qualify your business for the Employee Retention Credit:

Change in business hours

Partial or full suspension of your operations

Shutdowns of your supply chain or vendors

Reduction in services offered

Reduction in workforce or employee workloads

A disruption in your business (division or department closures)

Inability to visit a client’s job site

Suppliers were unable to make deliveries of critical goods or materials

Additional spacing requirements for employees and customers due to social distancing

Change in job roles/functions

Tasks or work that couldn’t be done from home or while transitioning to remote work conditions

Lack of Travel

Lack of Group Meetings

There are two ways to qualify:

FULL OR PARTIAL SUSPENSION OF BUSINESS OPERATIONS A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel, or restrictions of group meetings.

GROSS RECEIPTS REDUCTION Gross receipt reduction criteria are different for 2020 and 2021 but are measured against the current quarter as compared to 2019 pre-COVID amounts.

There are two ways to qualify:

FULL OR PARTIAL SUSPENSION OF BUSINESS OPERATIONS A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel, or restrictions of group meetings.

GROSS RECEIPTS REDUCTION Gross receipt reduction criteria are different for 2020 and 2021 but are measured against the current quarter as compared to 2019 pre-COVID amounts.

Yes. Under the Consolidated Appropriations Act, businesses can now qualify for the ERC even if they already received a PPP loan. Note, though, that the ERC will only apply to wages not used for the PPP.

We can’t use wages covered by PPP loans and apply them to ERC. There is a “no double-dipping” rule governing the interplay of an employer’s forgiven PPP loan and its eligibility for ERC.

Yes, for example, if a company’s ERC refund was $100 and BLC commission was $30 then the company would lose taxable expense deductions for the net $70 and the net effect would be an increase to its taxable income.

Yes, for example, if a company’s ERC refund was $100 and BLC commission was $30 then the company would lose taxable expense deductions for the net $70 and the net effect would be an increase to its taxable income.

The refund is a deduction in the payroll expense for the period that the credit is for. The interest that the IRS pays on the credit is considered taxable income in the period that the payment is received.

As with any fillings that are done with the IRS there is always a chance that you can get audited, however, with the volume that the IRS is processing and their short staff levels it is highly unlikely, the audit rate for employment-related tax returns for the last year that the data was available for was under 3 per 10,000 returns. In the unlikely event that you do get audited, while we can’t represent you we will assist by providing all of the supporting documentation to back up the work that we did.

If you have a contact for Bottom Line to bring in as a Referral Partner please fill out Schedule B so we can ensure they are listed as your referral in our system.

If you have a referral you would like to introduce to Bottom Line, prior to making the introduction, please fill out this Schedule A.

The program began on March 13th, 2020 and ends on September 30, 2021, for eligible employers.

An eligible employer claiming a refundable credit for any quarter in 2020 must file its 941x forms by April 15, 2024.

An eligible employer claiming a refundable credit for any quarter in 2021 must files its 941x forms by April 15, 2025.

We have clients who received refunds only, and others that, in addition to refunds, also qualified to continue receiving ERC in every payroll they process through December 31, 2021, at about 30% of their payroll cost.

We have clients who have received refunds from $100,000 to $6 million.

Your business qualifies for the ERC, if it falls under one of the following:

A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings.

Gross receipt reduction criteria is different for 2020 and 2021, but is measured against the current quarter as compared to 2019 pre-COVID amounts.

Yes. To qualify, your business must meet either one of the following criteria:

Experienced a decline in gross receipts by 20%, or

Had to change business operations due to government orders

Many items are considered as changes in business operations, including shifts in job roles and the purchase of extra protective equipment. The ERC, in this case, also applies only for Q3 and Q4 of 2021. Businesses can qualify, regardless of the number of full-time employees.